Ecommerce tracking isn’t new to Google Analytics. Retailers have been using this data to track online transactions for years. But eCommerce tracking isn’t just for online retailers. Credit unions can (and should) be using Google Analytics eCommerce tracking to monitor submitted applications to better calculate ROI.

If your credit union is already tracking the number of submitted applications through Google Analytics goals, that’s great, and important to do. But you can take this tracking one step further. Similar to how an eCommerce website would track individual products sold and their revenue in the Google Analytics eCommerce report, a credit union can track an individual loan application and its value the exact same way.

eCommerce Tracking Set Up

Unfortunately for credit unions, eCommerce tracking is not automatically built in to loan tracking systems (LOS) like it is for retailers that use major eCommerce companies like Shopify, WooCommerce or BigCommerce.

To get eCommerce tracking, credit unions first have to work with a developer from their LOS provider to implement code. This may not be possible for all LOS providers. Looking to do this for your credit union? Contact us and we’ll help you see if it’s possible.

It is also important to note that cross domain tracking should already be set up so that applications can be tied to individual campaigns. This is a required step in calculating the ROI of a marketing campaign.

Products in Google Analytics eCommerce Tracking

Once eCommerce tracking is set up, your credit union’s loan products and types of accounts will be listed as products. For example, you might see a list that includes the following:

- New Auto Loan

- Used Auto Loan

- Personal Loan

- Checking

- Savings

- Credit Card

What shows up will vary upon what your organization offers.

The Product Revenue field of the eCommerce report will capture the loan amount request, not the loan amount funded (more on that later).

For checking and savings products, the Product Revenue field captures the amount put in by the member.

Let’s look at an example:

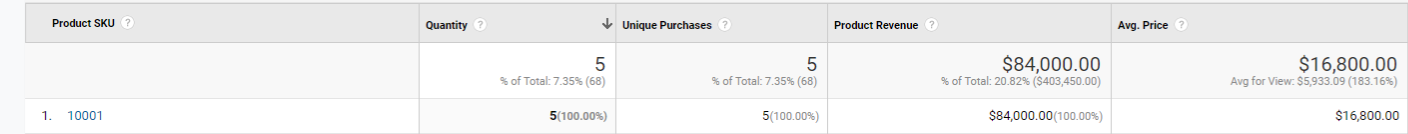

This particular auto loan product (Product Sku ‘10001’) was applied for 5 times in this time frame for a total of $84,000.00 in “Product Revenue” (which, in our case, means $84,000 in applied loan value).

Of course, knowing the total loan amount applied for is not all the data credit unions need. They will want to know if the loan was funded or not. That’s where Transaction IDs come into play. Transaction IDs will allow us to look at each application conversion event individually and ultimately see if the loan was funded or not.

Transaction IDs in Google Analytics eCommerce Tracking

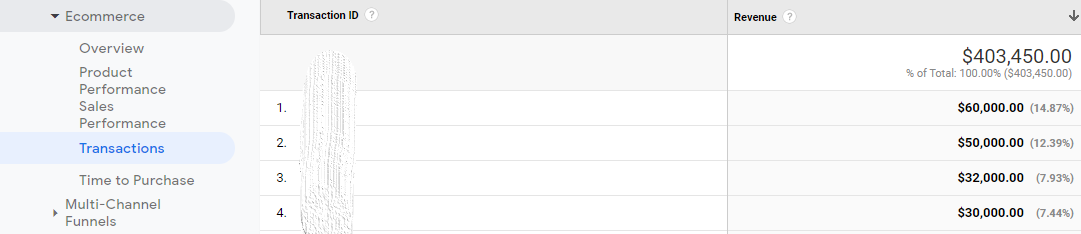

Under the Transactions section of eCommerce in Google Analytics, you get a list of numbers labelled “Transaction ID”, like the one below:

Transaction IDs are a unique identifier for every application submitted through your LOS. The Transaction ID value gets set in Google Analytics then passed into the LOS (along with the rest of the loan application information). With the Transaction ID now in the LOS, you can compare individual applications submitted with actual loans funded

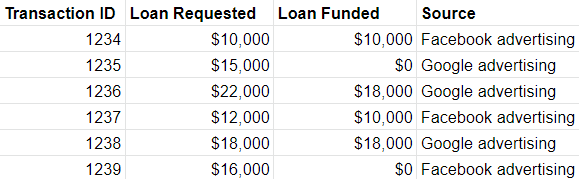

Here is an example of what it looks like to compare ‘Loans Requested’ with ‘Loans Funded’ when tied to the Google Analytics Transaction ID:

Note: Google Analytics does not display the loan applicant’s personal information (such as their name). Ecommerce tracking will only show applications by unique transaction ID, which is why we rely on Transaction ID to bridge the gap between our marketing channel and LOS data.

Segmenting Data in eCommerce Tracking

The final piece of the puzzle fits when you segment eCommerce data to show the source of the application. You will need to know if the application came from paid advertising, organic advertising, etc.

This is where the magic really happens, because while comparing loans applied and loans funded has always been possible, segmenting that data by online marketing channel has not.

What eCommerce Tracking Lacks

Ecommerce tracking is meaningful data to have, but doesn’t tell the whole story of profitability. Google Analytics users will still want to look at assisted conversions to see all data, not just last-click attribution conversions.

Additionally, there is no “abandoned cart” feature built in eCommerce tracking. In credit union terms, this means you are unable to see if a member started and application and abandoned it.

The Big Picture about eCommerce Tracking

Overall, eCommerce tracking could make a major impact on how reporting is done. The ability to know the value of submitted applications and whether or not those applications were funded means that digital marketers will be able to better measure the success of campaigns.

Ecommerce data provides a clearer picture of which online tactics are working and which ones aren’t so that marketers can make strategic changes. The implementation of eCommerce tracking is a win-win for both digital marketers who want to analyze the success of campaigns and credit unions who are seeking optimal ROI for marketing efforts.

BONUS SECTION: Taking eCommerce Tracking to The Next Level By Calculating Actual ROI

We know that ROI is at its simplest definition revenue divided by spend. Advertising ROI is revenue from advertising divided by advertising spend.

Knowing how much is spent in advertising is easy. Calculating revenue from advertising is more complicated. Here is the formula do that:

Applications from advertising x funded application rate x average interest rate x average loan size = revenue from advertising

Until eCommerce tracking, the funded application rate had to be an estimate. But through the use of cross-referencing transaction IDs (explained above), we can know the exact funded application rate. We also know the average loan size from eCommerce tracking data, and the number of applications from advertising by segmenting that data.

To complete this formula, the marketer does need to know the average interest rate for the loan product. Ecommerce marketing cannot provide this information and since interest rates can vary based on external factors (like credit score, duration of loan, etc.), ROI will still be an estimate. But it will be a closer estimate than it was before.

Agree, disagree, or just have something to add?

Leave a comment below.