-1.png?width=1875&height=1094&name=Blog%20Post%20Feature%20Images%20(7)-1.png)

When you first start using HubSpot at your credit union, it's important to get some early wins.

Quick win campaigns demonstrate the value of HubSpot, build confidence in the platform, and generate momentum for future efforts.

In this post, we'll explore two high-impact quick win campaigns you can run in HubSpot in your first 6 months, as well as some additional quick win ideas.

Would you prefer to watch the webinar? You can get more in-depth details by watching here: Laying the Groundwork for HubSpot Success.

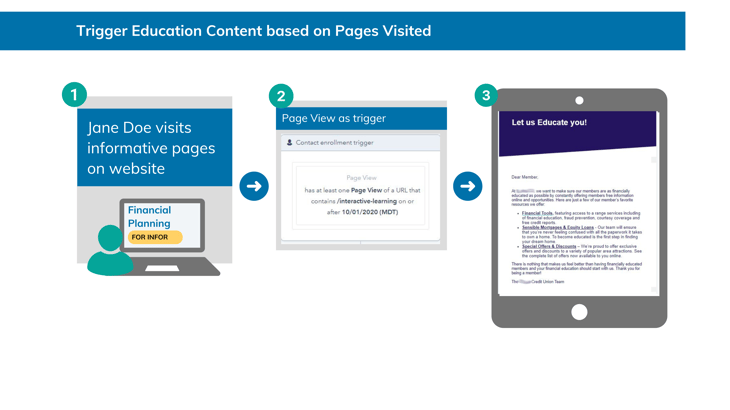

1. Lead Nurturing Campaign Based on Website Interactions

One powerful, quick-win campaign is a lead nurturing campaign based on website interactions. Here's how it works:

- A member visits your credit union's website and views a product page, such as a car loan page.

- HubSpot tracks this interaction.

- Members who meet certain criteria (e.g., viewed the page multiple times) are automatically enrolled in a lead nurturing email workflow.

- The workflow sends a series of personalized emails related to the product they viewed, encouraging them to apply.

To set up this campaign, you'll need:

- HubSpot tracking code installed on your website

- A HubSpot form on your website to capture lead information

- A lead nurturing email workflow in HubSpot

- Appealing email content related to the product

This type of campaign can be highly effective because it targets members who have already shown interest in a specific product. By providing them with timely, relevant information, you can nudge them closer to an application.

2. Abandoned Application Campaign

Another high-impact quick-win campaign is an abandoned application campaign. Here's how it works:

- A visitor starts an application on your credit union's website but doesn't complete it.

- HubSpot identifies this abandoned application.

- The visitor is automatically enrolled in an abandoned application email workflow.

The workflow sends a series of personalized emails encouraging the visitor to complete their application.

To set up this campaign, you'll need:

- A "Step Zero" form on your website to capture initial applicant data

- Integration between your application system and HubSpot to track completions

- An abandoned application email workflow in HubSpot

- Compelling email content to encourage application completion

Abandoned application campaigns can be incredibly effective at driving conversions. Often, applicants abandon due to distraction or uncertainty, not lack of interest. A timely reminder can be all it takes to get them to complete the application.

Additional Quick Win Campaign Ideas

Beyond these two campaigns, other potential quick wins include:

- Birthday or Member Anniversary Campaigns: Send personalized emails to members on their birthdays or membership anniversaries, perhaps with a special offer.

- Cross-Sell Campaigns: Identify members who hold one product (e.g., a checking account) but not another (e.g., a credit card). Send targeted emails promoting the additional product.

- Onboarding Campaigns: Create an email onboarding series for new members to educate them about your credit union's services and build engagement.

- Review Request Campaigns: After a member interacts with your credit union (e.g., takes out a loan), send an email requesting an online review.

Tips for Successful Quick Win Campaigns

To make your quick win campaigns as successful as possible:

1. Set clear goals and KPIs upfront.

2. Segment your audience to ensure relevance.

3. Personalize content as much as possible.

4. Test and iterate based on results.

5. Celebrate and communicate successes to build excitement.

Remember, quick-win campaigns aim to demonstrate value and build momentum. Start simple, execute well, and let the results speak for themselves. As you gain more experience with HubSpot, you can layer in more complexity and automation.

With a few well-executed quick-win campaigns, you'll be well on your way to HubSpot success at your credit union.

We have created a 60+ page detailed guide especially for Credit Union Marketer's looking to implement HubSpot. Would you like a copy? Just click below!

-1.png?width=6000&height=1200&name=Free%20Ebook%20Website%20Banner%20(2)-1.png)

Agree, disagree, or just have something to add?

Leave a comment below.