Implementing new software like HubSpot at your credit union can be a game-changer for your marketing efforts, but laying the groundwork for success is crucial. Preparation ensures your HubSpot implementation is smooth, efficient, and effective. In this post, we'll explore the steps you should take in the first 6 months to set your credit union up for success with HubSpot.

Read More

Topics

Hubspot,

Credit Union Marketing,

HubSpot for Credit Unions,

Credit Union Marketing Benchmarks

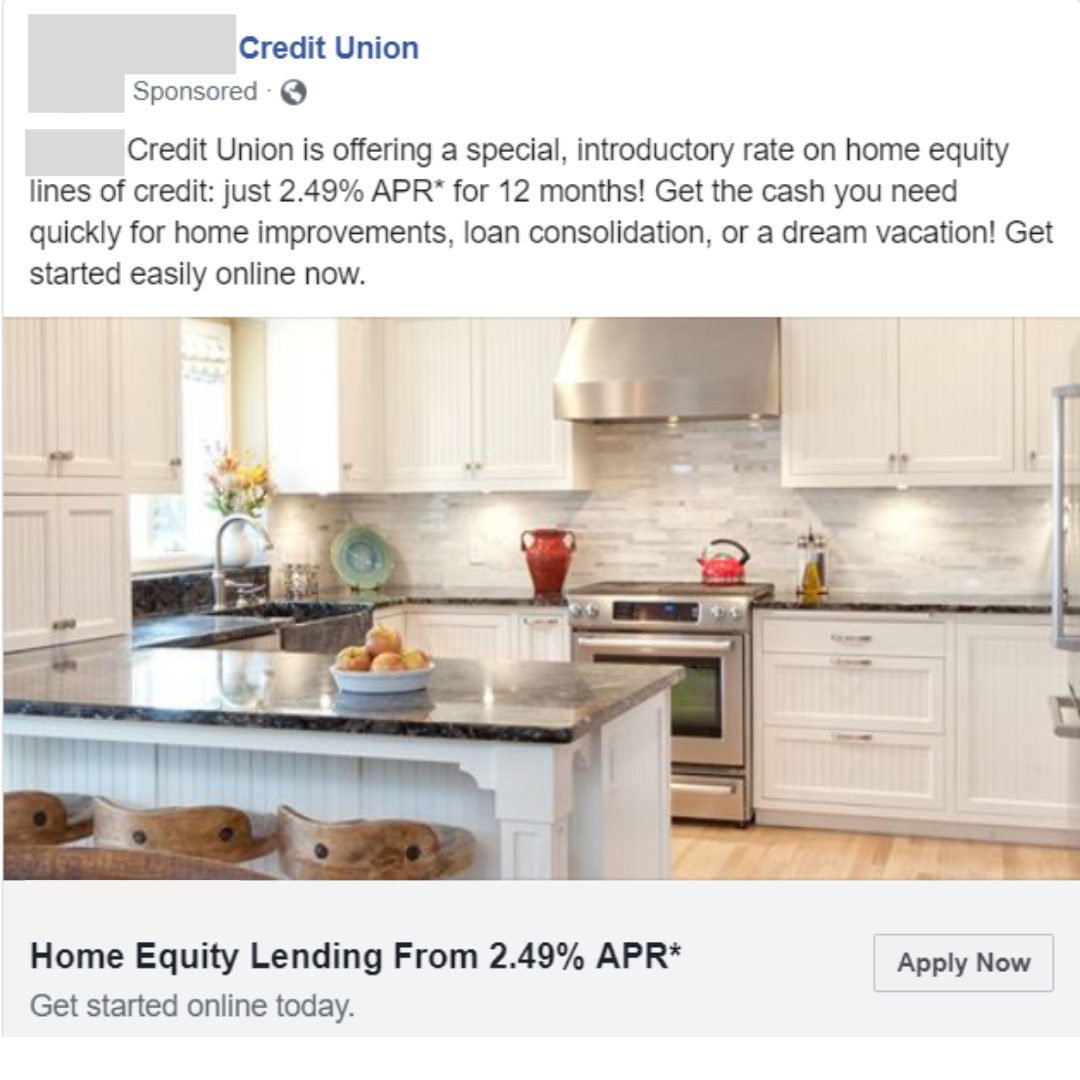

Love them or hate them, the guidelines of Meta’s ad platform greatly impact the ways credit unions market their services.

Read More

Topics

Facebook,

Digital advertising,

Credit Union Marketing

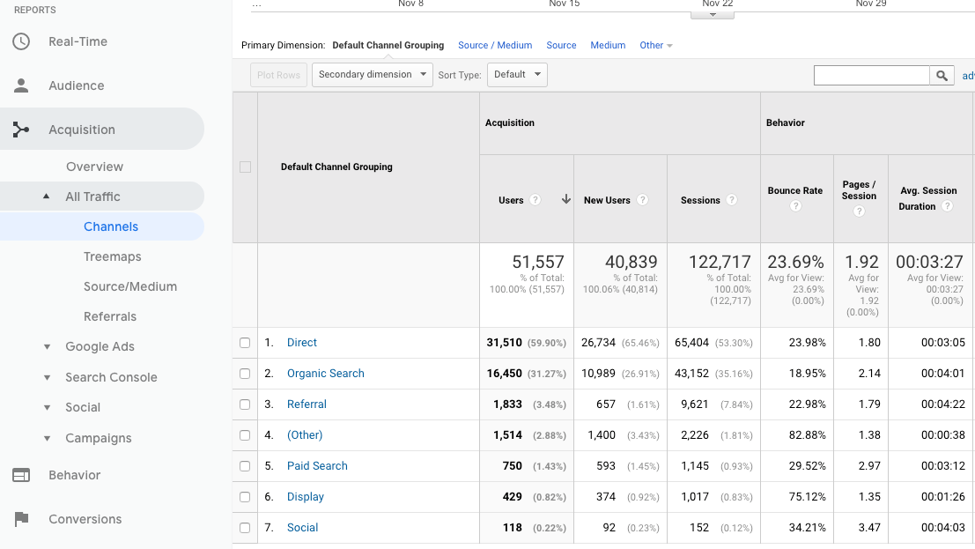

You think your website is attracting a fair amount of traffic—but is it truly performing as well as you believe? Are you above or under the industry average? We know that every marketer wants accurate analysis, so let's dive into the data and help you assess your website traffic with confidence.

Read More

Topics

Credit Union Marketing,

Credit Union Marketing Benchmarks

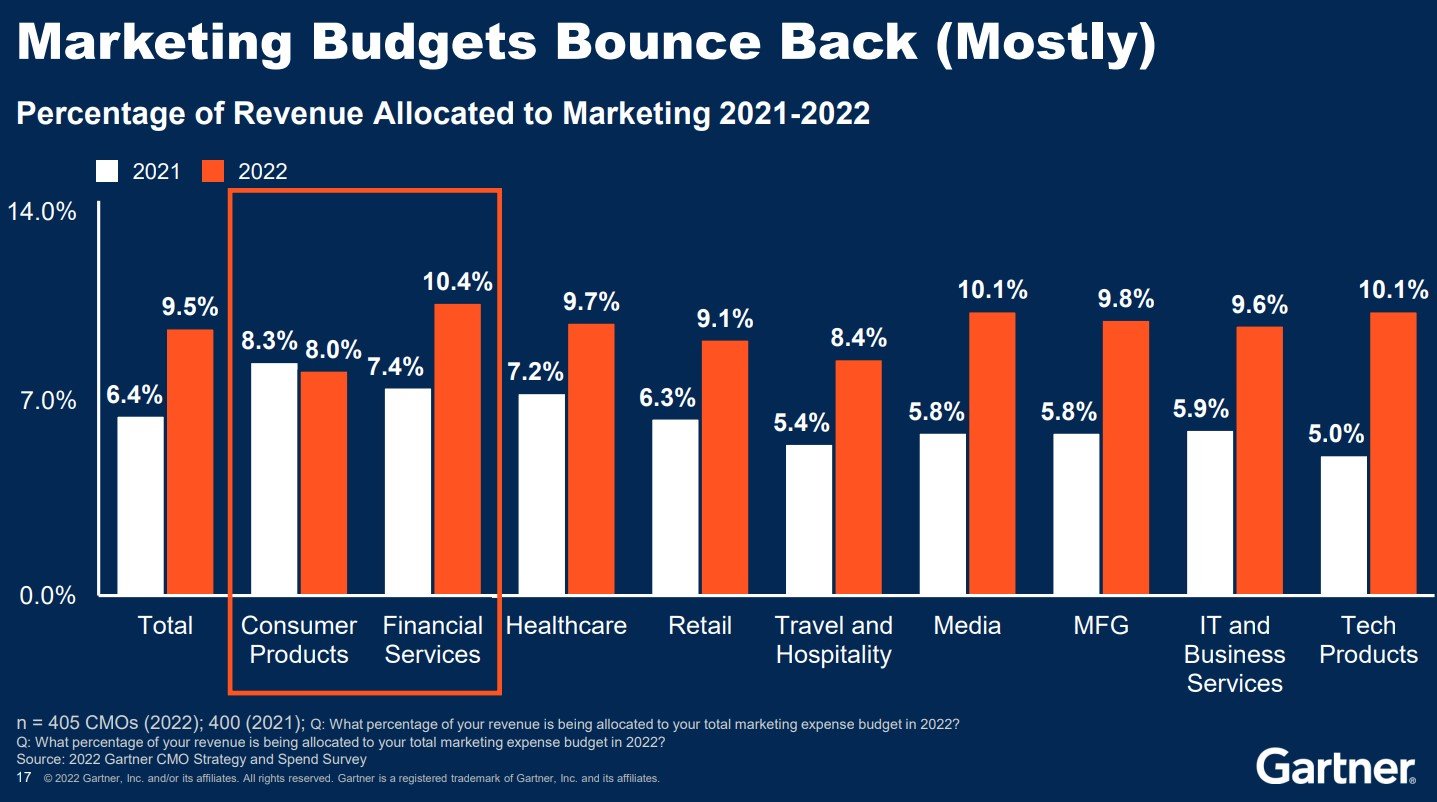

As a credit union marketer, you may have a hard time keeping up with fast-changing digital marketing trends–especially if you’re juggling many responsibilities. We also often hear frustration with not being able to show a positive ROI and prove the value of digital marketing efforts.

Read More

Topics

Credit Union Marketing

In 2019, we published part two of WebStrategies’ annual benchmark report blog series to discuss the average bounce rate for credit union websites. However, this metric means something totally different in GA4 than what it was in UA.

Read More

Topics

Credit Union Marketing,

Credit Union Marketing Benchmarks

It’s critical to have concrete ways to track ROI on investments to your credit union’s marketing efforts. To do that, you need accurate data that you can rely on to make sound decisions. The problem is, credit union marketing metrics can be difficult to establish, understand and evaluate.

Read More

Topics

Reporting,

Credit Union Marketing

You know the difference between your credit union and local and national banks. Banks can’t compete with your interest rates. You also know that you provide more personal, attentive customer service than banks.

Read More

Topics

Credit Union Marketing

We regularly update this article with the latest information pertaining to Digital Marketing Budgets for Credit Unions. Last update: November 2023

Read More

Topics

Credit Union Marketing

Social media advertising for credit unions has changed quite a bit over the past few years. Finding and converting your target audience on Facebook or Instagram at one point felt akin to shooting fish in a barrel; not only could advertisers tap into the demographic attributes and on-platform interests and behaviors provided directly by users, but Facebook’s partnerships with third-party data providers allowed advertisers even more opportunities to target exactly the right person with the right message.

Read More

Topics

Facebook,

Digital advertising,

Credit Union Marketing

Do a quick search for “credit union marketing strategies”, “credit union marketing plan” – or even “how to market a credit union”. You’ll find a lot of the same, thin recommendations over and over again. Most articles focus on guerrilla marketing, direct mail, in-person relationship management, and other suggestions that are not even really strategies. What’s not covered in depth is online marketing strategies for credit unions.

Read More

Topics

Credit Union Marketing