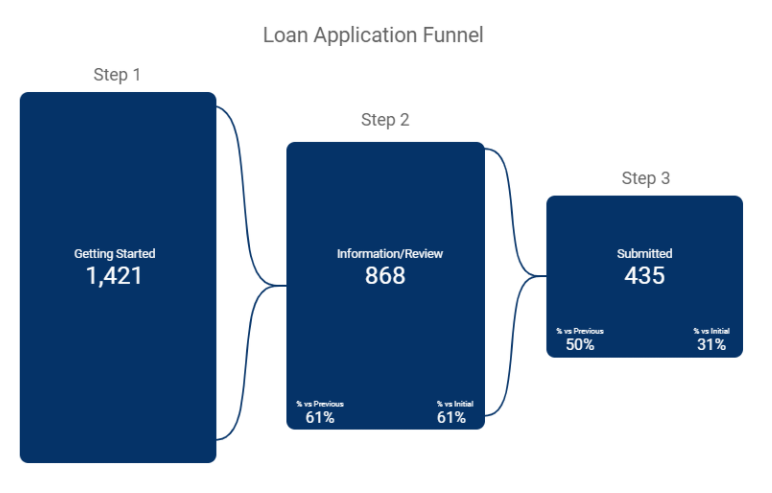

What do our credit union clients want most? Tracking! Many of our credit union clients come to us because they want better tracking and reporting. They want to be able to show that their digital marketing efforts are making an impact on business, leading to submitted applications.

Read More

Topics

Reporting,

Credit Union Marketing

What do our credit union clients want most? Tracking! Many of our credit union clients come to us because they want better tracking and reporting. They want to be able to show that their digital marketing efforts are making an impact on business, leading to submitted applications.

Read More

Topics

Reporting,

Credit Union Marketing

What do our credit union clients want most? Tracking! Many of our credit union clients come to us because they want better tracking and reporting. They want to be able to show that their digital marketing efforts are making an impact on business, leading to submitted applications.

Read More

Topics

Reporting,

Credit Union Marketing

What do our credit union clients want most? Tracking! Many of our credit union clients come to us because they want better tracking and reporting. They want to be able to show that their digital marketing efforts are making an impact on business, leading to submitted applications.

Read More

Topics

Reporting,

Credit Union Marketing

Like many other industries, marketing in the financial space is rapidly changing. Consumers are researching online for financial products at a higher rate than ever before, and FinTechs like Ally and SoFi are setting a new standard for the online experience that consumers expect from their financial partners.

Read More

Topics

Credit Union Marketing

Your website is the ultimate hub for your credit union. Each day, thousands of users visit your site to log in to their accounts, make payments on loans, receive financial education, or research more about why they should choose you as their financial partner. Every page on your website is valuable, but some hold more weight than others. This post will explore two of the most important types of pages for credit union websites: product pages and location pages.

Read More

Topics

Credit Union Marketing

Pressured to show immediate success, or lacking deeper insight into marketing performance, it’s easy for credit union marketers to rely on vanity metrics to guide their decision-making process. However, these metrics only support non-transactional marketing goals and don’t provide you with the entire picture of how your campaigns are performing. Your decisions should be backed by more sophisticated metrics like cost per application and funded loans to get the best results from your credit union marketing strategy. These metrics show the real impact that your efforts are having on your credit union, and allow you to make adjustments to where you focus your time and marketing budget.

Read More

Topics

Credit Union Marketing

An effective marketing campaign creates results. But how good are those results? What outcomes did they lead to? Every credit union marketing campaign needs to be analyzed to determine effectiveness. No matter how creative, interesting, or responsive it is, you have to ask what came of that campaign. Did it reach the goals you desired? Was it worth the investment? By analyzing the results of any campaign, you can then make decisions on how to further improve it to achieve an even better ROI. Analyzing campaign success leads to even better results next time. It also allows you to be more selective in your marketing.

Read More

Topics

Credit Union Marketing

As one of the most effective tactics to build brand awareness and drive new memberships and loan applications, advertising commonly consumes a large portion of a credit union marketing budget. The advertising landscape has changed drastically over the last several years. There are now numerous options across both the traditional and digital advertising world, and credit unions must be strategic in how they distribute their advertising budget.

Read More

Topics

Marketing budgets,

Credit Union Marketing

When credit union marketing is discussed, the focus is often on how to attract new members. In doing so, nurturing current members can fall to the wayside. However, in reality, it’s crucial to keep your current members engaged and make them aware of products and services that will meet their financial needs.

Read More

Topics

Credit Union Marketing