Generative AI has emerged as a game-changing technology, revolutionizing the digital world in unprecedented ways. From industry advancements to the potential for credit unions to leverage this technology, the impact of generative AI cannot be overstated.

In a recent webinar, the WebStrategies team explored the magnitude of generative AI's influence across various sectors and delve into how credit unions can harness its power to optimize their marketing strategies, improve SEO, and secure top rankings in search engine results.

Generative AI's Influence on the Tech Landscape

Generative AI has experienced a meteoric rise in popularity, evident from its widespread adoption and rapid user base growth. For instance, ChatGPT, a leading generative AI application, amassed a staggering 100 million users in just two months. Comparatively, popular apps like TikTok and Instagram took much longer to achieve similar milestones. The technology has also gained significant attention in the business world, with over 300 mentions of "generative AI" in Q1 earnings calls by public companies. Unlike other buzzworthy technologies such as crypto and blockchain, AI's potential to disrupt lives is widely recognized.

Incorporating AI into Credit Union Operations

Generative AI holds immense potential for credit unions in various operational aspects. Examples from other industries demonstrate how AI can be harnessed effectively.

For instance, Wendy's is working on automating drive-thru service, to deliver customer experiences that are expected to exceed even the best human representatives. This could serve as an interesting application for credit unions - AI-enhanced customer service, making it faster and more efficient.

For instance, Wendy's is working on automating drive-thru service, to deliver customer experiences that are expected to exceed even the best human representatives. This could serve as an interesting application for credit unions - AI-enhanced customer service, making it faster and more efficient.

AI's transformative capabilities in different industries make it essential for credit unions to explore how it can optimize their operations.

Generative AI and Search Engine Rankings

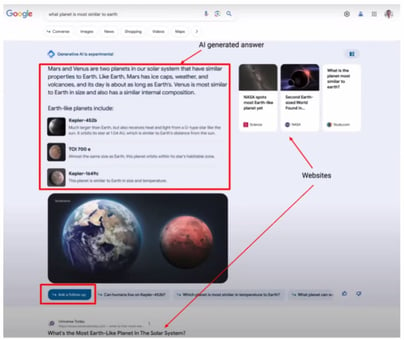

As users evolve the way they use AI tools such as Bard (Google) and ChatGPT being used in Bing, it will impact search engine rankings and how credit unions can rank at the top. Google's Bard, a large language model aimed at rivaling ChatGPT, is poised to transform the daily usage of Google Search.

Google previewed a new interface that boasts a user-friendly interface that encourages longer engagement on the search engine results page (and less need to click through to the web pages that sourced the information), and its free accessibility gives it an advantage. Digital marketing agencies like WebStrategies are closely monitoring how these changes affect traditional search engine results and adapting credit union marketing strategies accordingly.

It is too early to know what will get credit unions to rank on at the top of results pages but Google's increasing preference for user perspectives and reviews further emphasizes the importance of testimonials and member-driven content. To secure top rankings in AI-generated search results, credit unions should focus on reputation management and ensure all pertinent information about their institution is readily available. Because AI search tools deliver results in a conversational style, using predictive information to answer the searcher's complete need before they type in multiple questions, credit unions should provide all of their information (location, rates, reviews) on their website for the generative AI tools to compile into a user's search results.

Incorporating AI into Credit Union Marketing Software

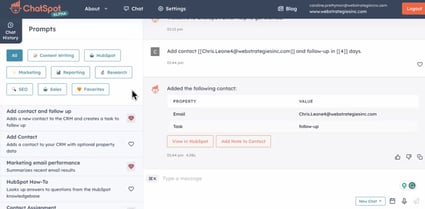

Increasingly, platforms are thinking of ways to layer AI onto existing tools to elevate abilities and effectiveness. Forward-thinking marketing platforms (CRMs) are already beginning to integrate AI, making tools more user-friendly and efficient.

ChatSpot, for instance, facilitates seamless communication with prospects and customers through the power of integrations with HubSpot. By leveraging AI, credit unions can streamline their marketing efforts, saving time and resources. AI-powered tools like ChatSpot are still in the infancy stage but as they grow, they increasingly allow for quick report generation, keyword analysis, and data visualization, enabling credit unions to easily make data-driven marketing decisions.

ChatSpot, for instance, facilitates seamless communication with prospects and customers through the power of integrations with HubSpot. By leveraging AI, credit unions can streamline their marketing efforts, saving time and resources. AI-powered tools like ChatSpot are still in the infancy stage but as they grow, they increasingly allow for quick report generation, keyword analysis, and data visualization, enabling credit unions to easily make data-driven marketing decisions.

Preparing for the Future with AI

Credit unions should embrace AI and invest in forward-thinking platforms that incorporate this technology. By bringing together data from various sources, credit unions can unlock valuable insights and outperform their competitors. While AI may reshape certain job roles, it will not replace human creativity and unique perspectives. Fluency in prompting AI and overseeing its outputs will be crucial skills for marketing professionals in the future.

More AI for Credit Unions

Webinars

Exploring AI Solutions for Credit Unions

Agree, disagree, or just have something to add?

Leave a comment below.