On several occasions, I have had the privilege of speaking to credit union or bankers groups and marketing professionals on the topic of unlocking YOUR digital marketing formula.

I emphasize "your" because everyone shouldn't use the same digital tactics. What works for one business may not work for another. We preach this message to our clients, including our many bank and credit union clients. Despite being in the same industry, the location of these financial institutions and what they're ultimately trying to achieve can vary.

To figure out the right formula, we need to break down who your specific customer is, what THEIR goals are, and how you can help them achieve those goals.

(See the theme starting to develop? This is about them, not about you.)

We kicked off a past workshop session by showing some industry trends (who doesn't love to take a peek at what everyone else is doing?). With marketing expenses representing around 7 to 12% of total revenue, investing in the wrong strategies is a costly mistake.

So, what is everyone else doing?

A recent report by Forrester Research shows over 80% of digital ad spend going towards search and display advertising, 15% towards social media, and only 3% towards email.

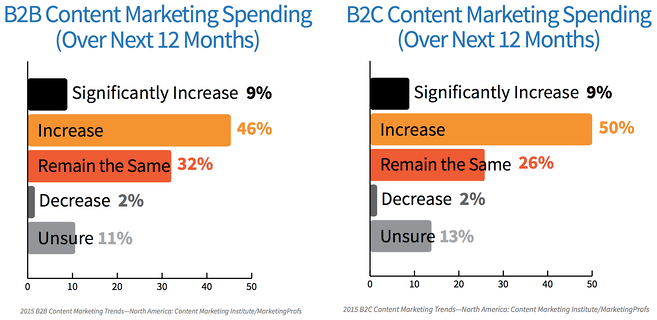

Another report from the Content Marketing Institute shows over half of both B2Bs and B2Cs increasing their content marketing spend in 2016.

Learn more about how much to budget for credit union or community bank marketing.

Don't take this data to mean you should distribute your spend and efforts similar to everyone else. For example, the channel with the smallest investment (email) is also considered the MOST effective. How you ultimately spend your time and money is contingent on your specific goals. In order to achieve your goals, we must focus on how your customers behave.

We refer to this behavior as your customer’s journey.

The customer journey tells the story of your customer’s entire buying experience. It begins with discovering their pain, then researching possible solutions, entering into the sales process, and eventually through to sale.

We break down the customer journey into four components: persona, properties, path, purpose.

Personas - who they are

Persona marketing documents, in a very detailed way, who you are marketing to. It starts by creating a fictional character of your customer, describing who they are, what their day looks like, and the pain or gain that drives their purchasing decisions.

This can be documented on a single sheet of paper.

This characterization of your customers focuses your marketing strategy. Instead of marketing to the masses, you focus on distinct individuals. And because these individuals represent a much larger population, what speaks to them will speak to your entire target market.

Properties - where they go

70% of the buying process happens anonymously, and it takes place on a combination of different web properties.

Properties are all the places a customer can research and discover your brand, product, or industry online. This could include your website, a mobile app, social media page, youtube, or customer review site.

Financial institutions need to know where their customers go to get informed, to obtain information, and to find solutions.

Path - how they get there

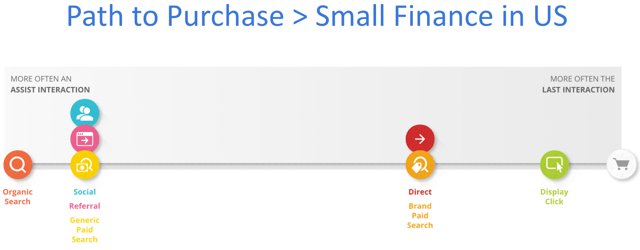

The path details the sequence of digital channels people use before making a purchase from you.

For banks and credit unions, search and social are popular channels for first discovering your website. During these early stages, users are searching NON-branded terms (e.g. banks near me, local credit unions, credit unions in my city, etc). As the customer gets closer to a decision, they will go directly back to your site or perform a branded search (searching your brand name directly in Google or Bing).

Knowing which channels are used at the beginning or end of the customer journey should impact how you value and prioritize them.

Purpose - what is accomplished at each stage

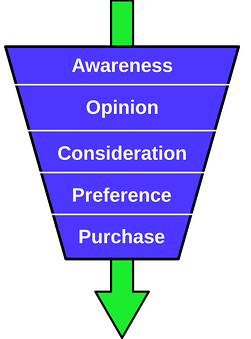

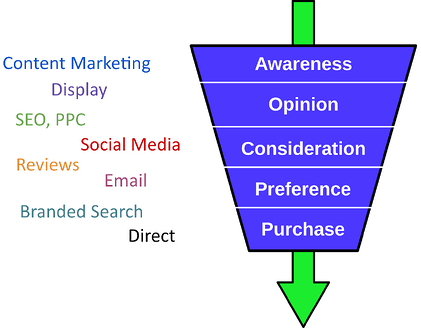

Finally, determine how each digital touch point can impact the user as they move through the buying funnel.

The buying funnel represents a sequence of steps a buyer takes before purchasing. First, they become aware of their problem, then consider their options, develop a preference among those options, and then buy. It looks something like this:

Different marketing messaging works better depending on where someone is in the funnel. Promotional messaging is ineffective early in the customer journey, but becomes more effective the closer someone is to purchasing.

Every property and channel in the consumer path has a purpose that fits in this buying funnel. When those properties address that purpose successfully, the marketing will be more effective.

How Banks and Credit Unions Can Discover Their Own Customers' Journey

The easiest way to better understand your customers begins by talking to them.

Get the names of five people who represent your target customer and who recently opened new accounts, then ask the following questions:

- When did you first realize you had a need?

- What was the first thing you thought of?

- What was the first thing you did?

- What sites did you visit?

- What did you search?

- When did you first find us?

- How long before you contacted us?

- What else did you see that was influential?

The more you ask, the more their journey will come into focus. Trends and similarities will begin to emerge, and your primary personas will be revealed.

Next, develop your persona pain statements. These are the thoughts or statements they have when the buying process first begins. A pain statement speaks to their problem, not your solution.

For most banks and credit unions, customer pain points are around not having the money they need to do what they want. Therefore, the customer's pain is about not having a material item or not pursue a business strategy due to lack of working capital.

After developing your persona’s pain statements, simulate their research phase. Identify which channels they use to begin researching their problem. Most will go to Google. Those who are new to taking on loans will want to know the process, cost, and how to make the right decision. This is your opportunity to intercept them with relevant, educational information that answers those questions and provides value.

Final thoughts on bank or credit union marketing

Banks and credit unions should focus on the entire customer journey. Financial decisions are some of the most stressful decisions, so by educating customers, and not simply selling to them, an early sense of loyalty can be developed.

Your formula is ultimately derived from how your customers behave. Get to know your customers and their behavior as much as possible, and the right formula will be revealed.

Want to learn more?

Visit our Credit Union Marketing resources page

Agree, disagree, or just have something to add?

Leave a comment below.