When credit unions onboard HubSpot to take advantage of the benefits that the CRM provides, it can be daunting to know where to start in creating workflows and how they are built. We’ve onboarded HubSpot for dozens of credit unions and found there are some that benefit practically every one.

But first, what is a workflow?

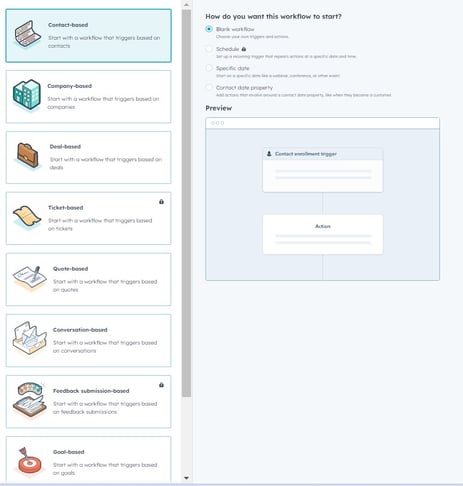

Workflows can be simple or multi-step processes (including decision trees) that execute action to an object based on a designated trigger. Before setting up the workflow you’ll need to determine the object that the workflow will work around as well as the trigger that initiates the workflow.

Objects can be any of the following:

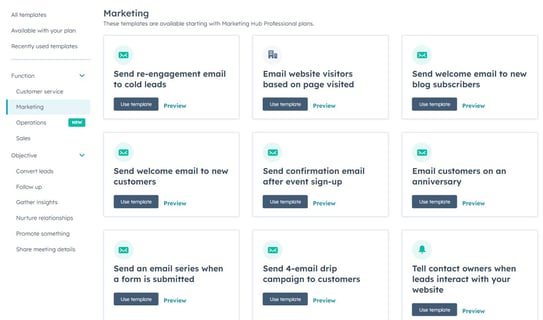

There are three main types of workflow: Operational, Marketing, and Internal. A bonus workflow is internal messages that are used with Sales Hub.

Some of the marketing workflow templates that are available:

1. Operational Workflows

Operational workflows are used for data management. They keep the database clean and update data points (contact, company, deal, or custom object records) based on user behavior as they interact with website content, forms, and calls to action.

The better your data, the better your targeting will be so an automated workflow that keeps it clean is needed for credit union marketing. Operational workflows perform updates that happen behind the scenes and keep data accurate so you can effectively:

- Create lists

- Enroll in lists

- Enroll in cross-sell or upsell opportunities

- Nurture them better

- Suppress people from lists based on their behavior

Follow best practices to keep mailing lists current with workflows to process contacts that unsubscribe, hard bounce, or are unengaged by using suppression lists in email and use a workflow to clear out the people from the database if you choose.

Examples of operational workflows for credit unions:

- If a prospect is in a five-step marketing automation workflow that promotes becoming a member and the prospect accepts the offer after the second message, a credit union should stop sending promotions once the goal is achieved. An operational workflow will remove them from the process that sends the original promotions.

- Using the lead scoring property with a workflow to assign scores to a contact based on their behavior that prioritizes leads for the sales team.

- Fix data formatting issues to correct typos, such as capitalizing the first and last names in a deal so formatting is consistent no matter how someone inputs their information. Also, correct common errors like changing "shelly@gmai.com" to "shelly@gmail.com." Personalized messages will be much more professional when the data displays correctly, and having a correct email address means your message can get through.

- Set lifecycle stages and lead statuses based on behaviors. If they move from marketing qualified leads (MQL) to sales qualified leads (SQL) and you want to alert a certain person, the workflow can update their contact record based on their behavior to move them along. Then, it can send an internal notification to the sales team as a hot lead (someone who manages mortgage inquiries, for example).

- Set contacts through a workflow as marketing or non-marketing contacts so that non-marketing contacts are not emailed and the company is not charged for having more marketing contacts in the database.

2. Marketing Automation for external communications

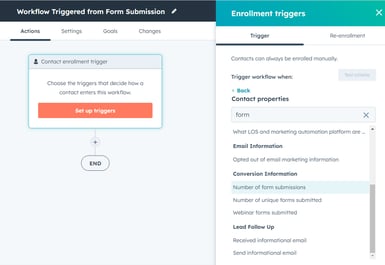

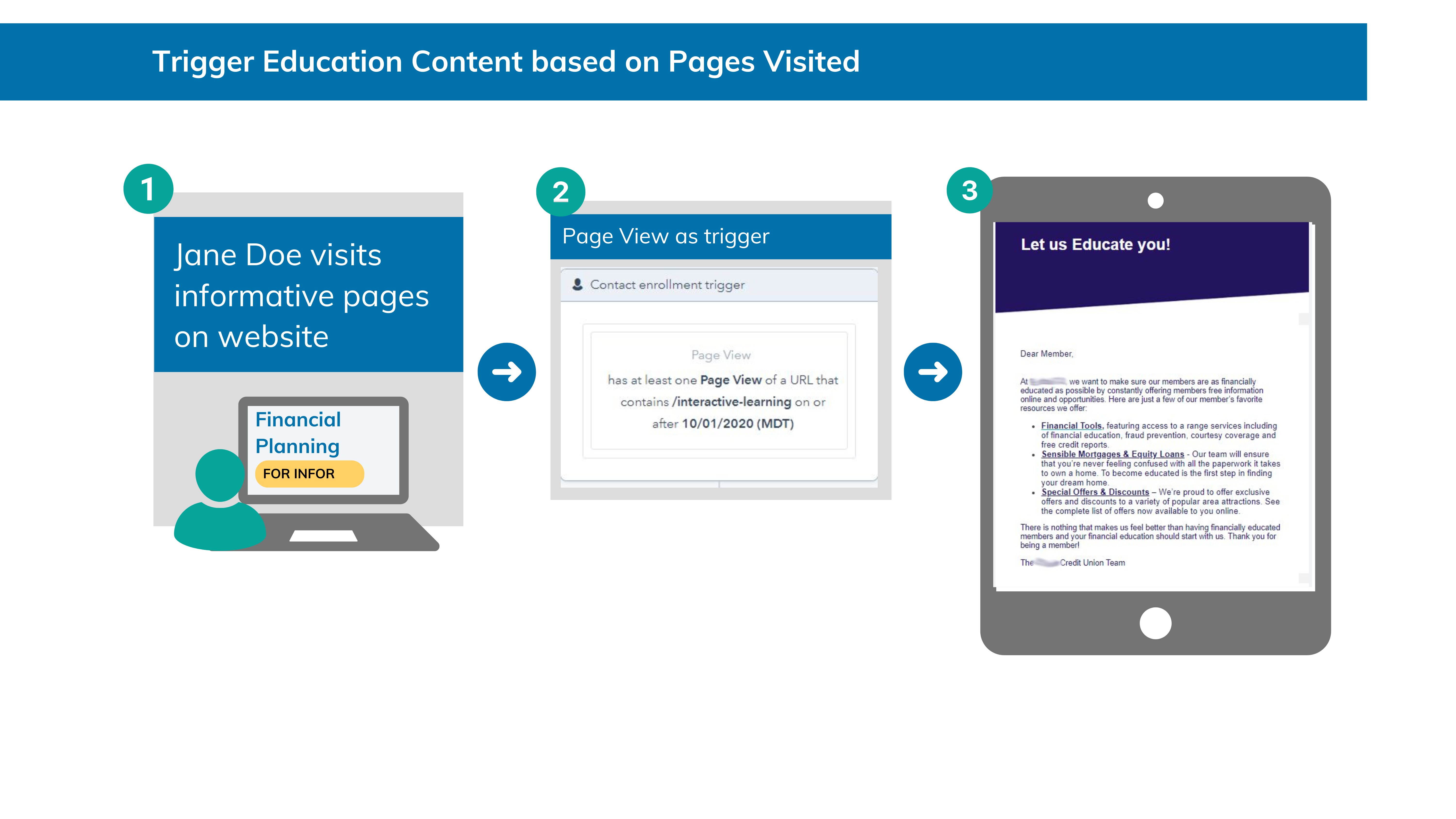

Marketing automation workflows are based on a trigger action, such as a property updated on the data management side such as a form submission, page view, or change to list membership.

Based on a trigger being met, a contact would be enrolled in a nurture series workflow such as:

Based on a trigger being met, a contact would be enrolled in a nurture series workflow such as:

- when an action is complete, send email 1

- set a delay then send workflow 2

- set if/then branches and suppress anyone who should not get the messages

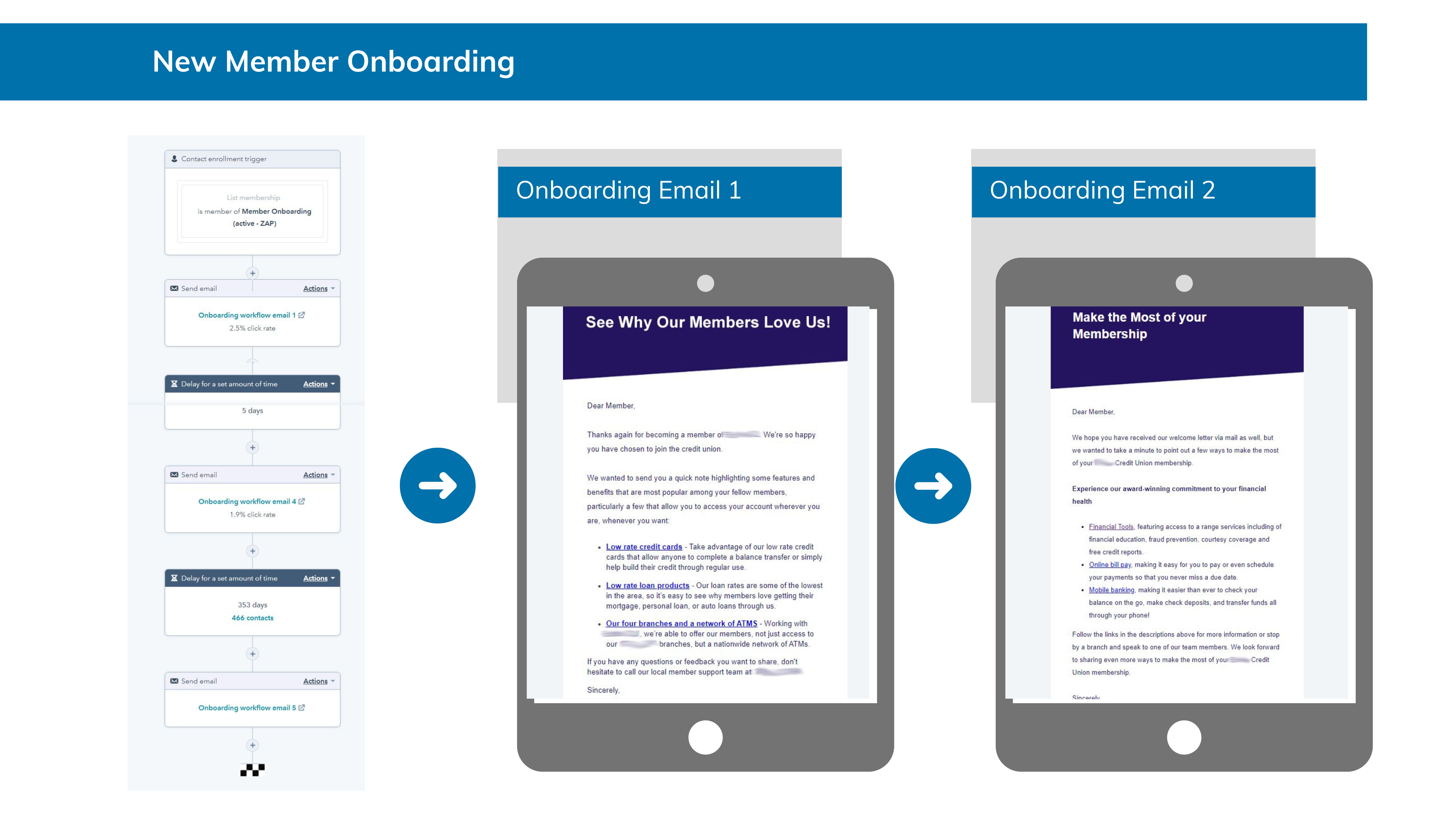

Setting goals will show how successful the workflow is. For example, if there is a series of five emails and the person converts (takes the desired action and goal is met) after the second email, then they become unenrolled from the remaining actions because the goal is achieved. This creates a better member/customer experience.

Examples of Marketing Automation Workflows for Credit Unions

We find Step Zero Forms drive tremendous engagement. The forms obtain information from an applicant prior to the online application system to keep in the CRM. That information can be used to Attract, Engage, and Delight prospects throughout the buyers’ journey such as:

-

- Reengaging abandoned application reminders to reengage the person who started the application but did not complete it.

- Create a record to enable contact for future promotions

With email marketing lists established, workflows help:

Attract Members

- Special campaigns: promote high-yield savings products

- Events a credit union hosts or sponsors can be promoted to its marketing list

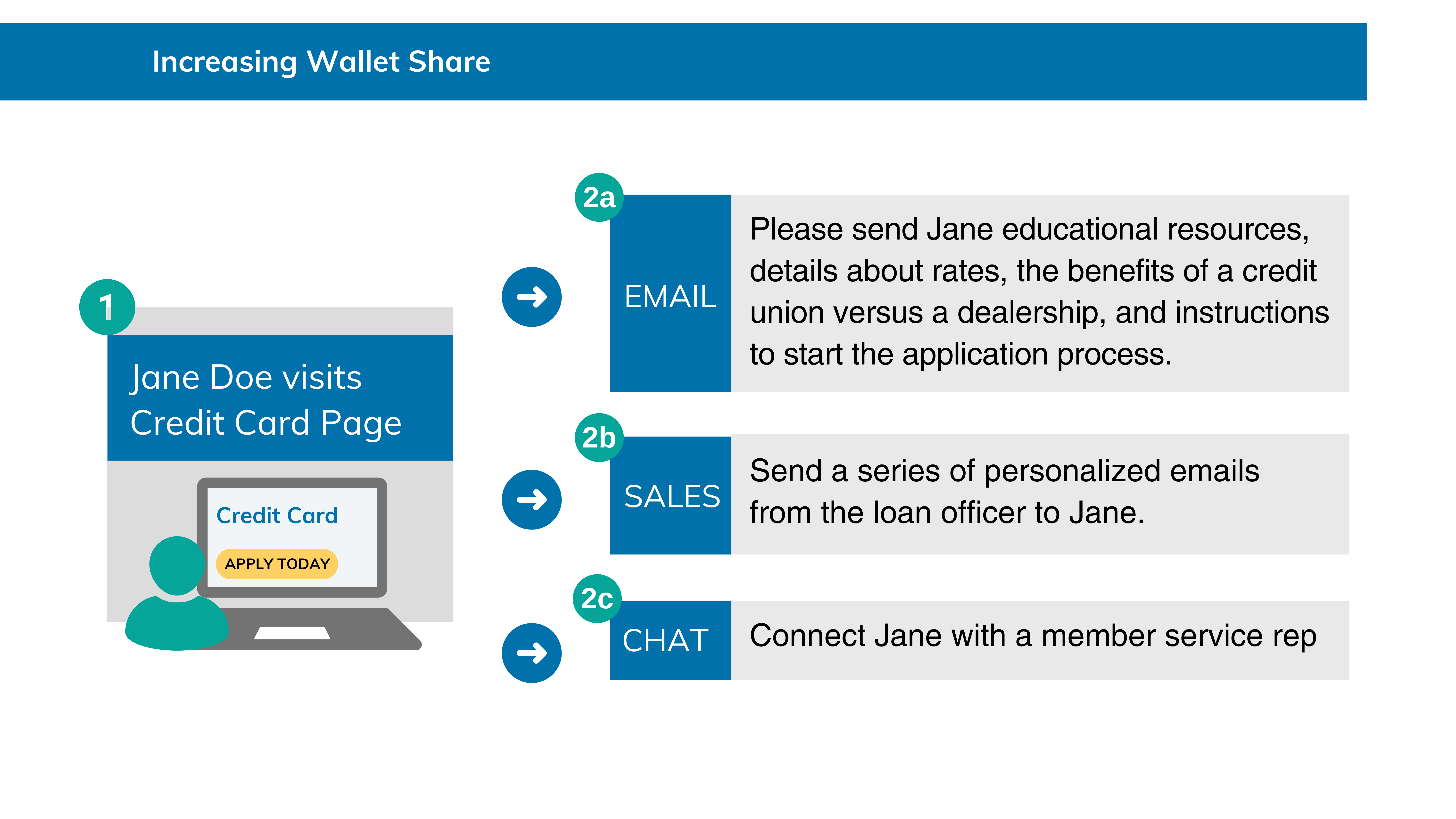

- Cross-sell/upsell: promote personal loans to someone with an auto loan

Engage Members

- Onboarding: welcome new members or product users with information that directly helps them to use services. Most credit unions already have pamphlets with this information that can be adapted for digital use and triggered with a workflow to send when the product setup is complete.

Delight Members

- Post survey messages that are sent depending on certain answers to a member survey to help answer questions or locate resources.

- Birthday and anniversary of membership messages based on dates

- Differentiate education materials sent to members with different products. For example, when new cardholders are enrolled it triggers a workflow that is filtered by the type of offer. The product determines the path and tailored education material is provided based on the type of product.

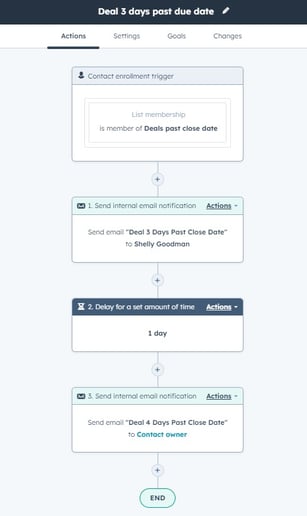

3. Internal Notification workflows notify others in the credit union

|

Use internal notification workflows when you want to know when a contact takes a certain action and set a trigger based on that action. When it’s met, HubSpot sends an internal notification to a designated member(s) of the team. For example, sales team members can be notified if a prospect started a conversion but didn't complete it, and the workflow will assign tasks to the team member. While form submission routing can often be managed on the form setup, circumstances may require several tasks that would be better handled with a workflow. For example, a workflow can handle updating their contact record and sending a confirmation email, as well as notifying the appropriate team member (contact owner). |

|

4. Sales Workflows (with SalesHub)

Business development team members can get internal notifications on the sales side that start conversations, deepen relationships, and manage the pipeline.

Sales workflows enable a valuable management tool managing leads by routing leads and assigning contacts so they are distributed throughout the team.

There are countless ways that workflows increase efficiency at credit unions by automating tasks and enabling communication with the right person at the right time. Leveraging the tools elevates credit unions' success rates and ROI on marketing campaigns.

HubSpot for Credit Unions

If you want to add HubSpot to your marketing stack, but don't want to go it alone, contact us because we have years of experience onboarding HubSpot at credit unions across the country. Or if you have it now but want to realize more of its potential, schedule a call and we'll be happy to brainstorm ways to improve HubSpot's effectiveness at your credit union.

Agree, disagree, or just have something to add?

Leave a comment below.