As one of the most effective tactics to build brand awareness and drive new memberships and loan applications, advertising commonly consumes a large portion of a credit union marketing budget.

The advertising landscape has changed drastically over the last several years. There are now numerous options across both the traditional and digital advertising world, and credit unions must be strategic in how they distribute their advertising budget.

With so many advertising options available, how much of your marketing budget should go towards advertising? Within that, how much of your advertising budget should be dedicated to digital advertising channels?

Read on to learn how to distribute your credit union advertising spend to generate the best results.

How much should you budget for marketing as a whole?

Data published in a special COVID-19 edition CMO Survey from June 2020 showed marketing budgets for the banking and financial industry as a whole sitting at an average of 13% of overall firm budget. This is actually up from 2019 numbers, which reported that marketing budgets as a percentage of a firm's total budget ranged from 11.99%-12.51% for the banking industry.

Additionally, data published in the CMO survey in February 2020 projected annual marketing budgets to increase by an average of 7.6%, with banking and finance as one of the fastest-growing industries.

Although this number has been likely impacted by the COVID-19 pandemic, growth is still expected and credit unions should be wary of cutting marketing budgets too dramatically and falling behind their competitors.

If you’d like more information on the latest trends in and guidance for planning your marketing budget, check out our post How Much Should Credit Unions Budget for Marketing? or click the button below to download your free marketing budget calculator.

Establishing Your Advertising budget

Based on data available for the latest trends in overall credit union advertising spending combined with analysis of our extensive list of credit union clients, we've calculated baselines for credit union advertising budgets.

We’ve determined that the average advertising spend per member per year is $1.16, with the highest spend among our clients being $3.60 per member and the lowest being $0.21.

As advertising spend relates to asset size among our clients, we're seeing an average spend of $91.13 per million in assets per year, with a high of $319.15 per million and a low of $20.13 per million.

How Much Should You Invest in Digital?

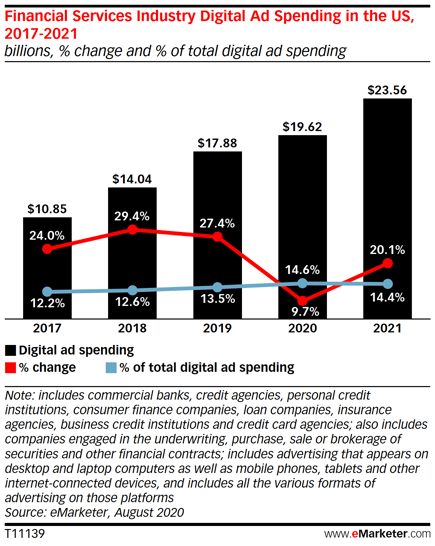

Digital advertising spend is rapidly increasing every year. According to a recent study by eMarketer, digital ad spending in the financial services industry will grow 9.7% this year to $19.62 billion, and rightfully so. After all, digital advertising has proven to be excellent at helping credit unions attract qualified applicants and generate revenue compared to traditional channels.

While 9.7% in growth actually represents a significant dip in growth year-over-year, this decrease is to be expected based on overall decreases in advertising and marketing spending across the board in 2020. It is significant that spending in this category continued to grow when spending for many other marketing channels showed negative growth.

In another survey by eMarketer in February 2019, the average company planned to allocate 62.3% of its total media ad budget to digital in 2021, with that rate increasing to 66.8% by 2023. Although many credit unions will fall short of this mark, these numbers are not uncommon to see from credit unions with aggressive growth goals.

It's important to note that those percentages relate specifically to ad spending, not marketing spending as a whole. However, we generally see a corresponding amount of overall marketing spend dedicated to digital versus traditional marketing tactics.

Among digital advertising, there are multiple platforms that you can utilize. Here is a look at how much you should spend on each platform:

Paid Search

Out of all of the digital advertising platforms out there, paid search is easily the best at driving direct conversions compared to other platforms. If your goal is to grow memberships through new loan applications or account openings, then the lion’s share of your advertising budget should be rewarded here.

The two primary search engines that you should focus your advertising on are Google and Bing. Google dominates over 90% of the total searches on the web, so the majority will be focused here.

For the best results, we recommend that you spend around 25% of your digital marketing budget on paid search advertising, or about 15% of your total marketing budget.

Outside of your search campaigns that are intended to capture high intent traffic and drive direct conversions, it’s also important that some of your digital advertising budget be allocated to channels that build top-of-mind awareness.

Facebook and Instagram are great options for this purpose. By utilizing email lists, lookalike audiences, and the advanced targeting options Facebook provides, you can easily reach your target audience as they casually scroll through their feeds.

We suggest that you spend between $500 to $3,000/month or about 11% of your digital marketing budget on paid social media advertisements.

Google Display Remarketing

Finally, one of the platforms that should receive a portion of your credit union’s advertising budget is Google Display Remarketing. With this platform, you can target anyone who has been on your website, related websites, or competitor websites and show them ads when they are browsing some of their favorite websites throughout the Google Display Network.

Although Display Remarketing is a great tactic, it should receive the smallest piece of your digital advertising budget compared to other channels like Google Search and social platforms.

Overall, we recommend that you allocate 5% of your digital marketing budget towards display remarketing or $300-$1,200/month.

Planning Your 2021 Credit Union Advertising Budget

As you plan out your marketing and advertising budget for 2021, it’s important that you are strategic about the different channels you invest in. In a year where marketing budgets are going to be heavily scrutinized, you can’t afford to waste valuable advertising dollars.

Aside from digital advertising, several other digital marketing tactics such as SEO, content marketing, and marketing automation should occupy portions of your marketing budget as well.

If you’re looking for guidance as you plan your credit union’s marketing budget and strategy for 2021, click the button below to download your free credit union marketing budget calculator which will break out how much your credit union should budget for marketing, digital marketing, and the various digital marketing channels.

Agree, disagree, or just have something to add?

Leave a comment below.