As a credit union marketer, knowing what the target audience cares about most is essential to crafting a message that resonates. Do you know what banking consumers under age 45 prioritize in their financial institution? Are you promoting the features that matter to them as competition increases against national banks and online-only banks for share-of-wallet?

In our recent Consumer Banking Preferences & Behavior Report, we focus heavily on the preferences of consumers under age 45 because that is the demographic in stages of life that are most likely to initiate loans and other financial services. Hence, it is the under-45 demographic that financial institutions primarily target since it is also the pipeline for ongoing business as older consumers are not as likely to originate loans or open new checking and savings accounts outside their primary financial institution (PFI).

About the Survey

The survey of 1,000 banking consumers featured an even representation of various age groups (18-24, 25-34, 35-44, 45-64, 65 or older) but in this post, we’ll focus on the 18-44-year-old range.

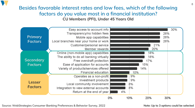

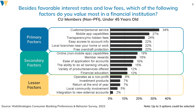

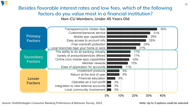

We broke out results based on whether respondents were credit union members (PFI), credit union members (non-PFI) and non-members. There were commonalities among all three groups of respondents under 45.

Click to expand each slide image below:

Credit Union Marketing to the Under 45 Audience

What do banking consumers under 45 care about most? Based on strong common results across these three groups, the values that should be promoted to both members and non-members under 45 are:

- Transparency/no hidden fees

- Easy access to account information

- Customer/personal service

- Mobile app capabilities

- Local branch near home or work

Messages to Drop in Credit Union Advertising

It may surprise credit union marketers to know what the under 45 audience values the least. Some of the things credit unions are best known for are reported as the audience's lowest priorities:

- Operates as nonprofit

- Financial education

- Local community involvement

- Integration to view external accounts

- Return at the end of the year

While being member-owned and a non-profit organization may be the reason credit unions are so good at lower fees and transparency, consumers are not very interested in the “why”. When comparing products, rates, and fees they want to know exactly what will be charged and for what reasons. So it may be time to shift promotions and website copy that focus on the non-profit status and community involvement to ones that focus rates and any associated fees in a simple, easy-to-understand format to promote financial products.

Focus Advertising Campaigns on Digital and Mobile Technology

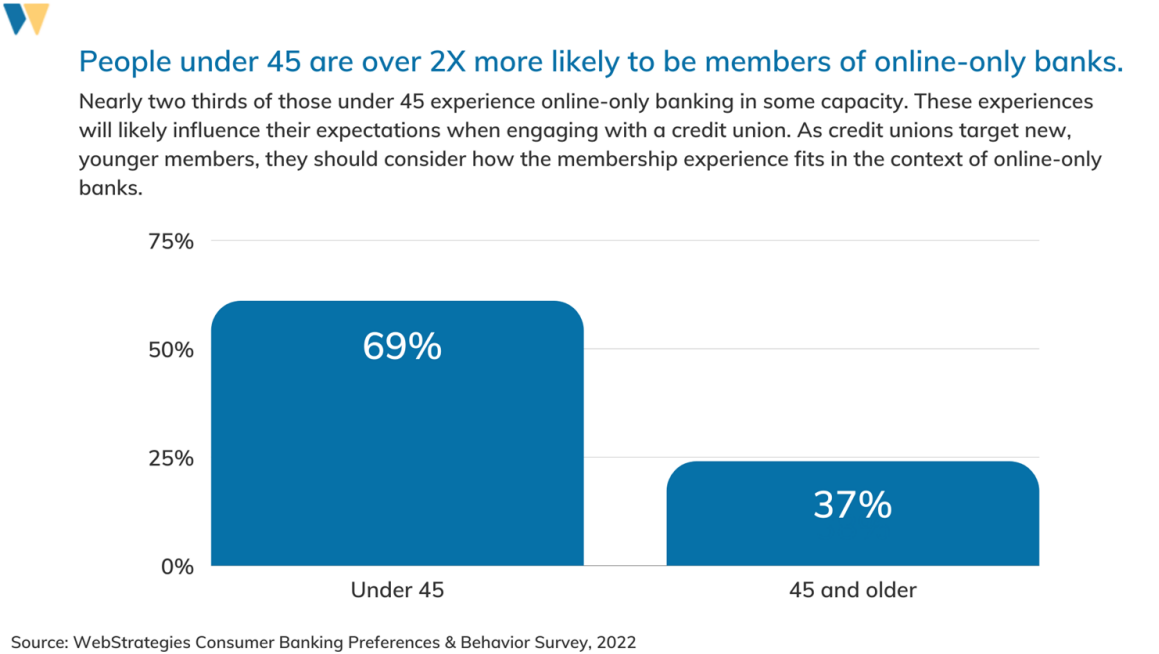

People under 45 are 2x more likely to be members of online-only banks and their experiences in the polished digital interactions will shape their expectations when engaging with a credit union.

Easy access to account information and mobile app capabilities are features that matter. If your credit union has an app and a website that allow members to quickly access account information and make transactions, then lead the marketing messages with those capabilities. Promotions touting the most desireable features on a credit union’s mobile app and online account are more likely to resonate. Assume that users are accessing their account information on a mobile device as 63% of search traffic in Q4 2021 was done on a mobile device, versus a larger desktop monitor. If your credit union’s website is formatted well for mobile devices and the app works well, these are the features to emphasize.

Credit Union Marketing: Low Fees as Competitive Advantage

Member-owned credit unions have historically been known for low penalty fees and our report echoes the value to consumers of Transparency/No Hidden Fees, so it is a great time to promote the difference between your fees and your competitors’. However, there have been recent moves by larger banks to eliminate, lower and cap fees associated with their products. And they are using large national marketing budgets to spread the word. Typically credit union fees have been much lower than banks' so it is a good time to show a comparison chart between your rates and fees to those of your main competitors to distinguish the credit union advantages.

Consumer Banking Preferences & Behavior Report

As Peter Strozniak wrote in the Credit Union Times, this report "shatters industry's conventional wisdom" on what the target audience values in a financial institution. It opens a window to see opportunities to more effectively connect with prospective members based on their priorities. We hope you'll take time to download and review The Consumer Banking Preferences & Behavior Report and implement the findings into your campaigns. We look forward to hearing your feedback and results!

Agree, disagree, or just have something to add?

Leave a comment below.