If you use Google Analytics, you've heard GA4 is replacing the Universal Analytics (UA) platform. Users will adapt to a new interface and website data that is reported differently. There will not be a direct comparison between the data we've been tracking in UA and the new GA4 so becoming familiar with the new format should start soon; the old system will sunset on July 1, 2023. Based on the popularity of our webinar on GA4, it's a topic that credit union marketers want to learn more about so we're breaking that session out into several bite-size portions for easier consumption. But you can always watch the GA4 for Credit Unions full recording.

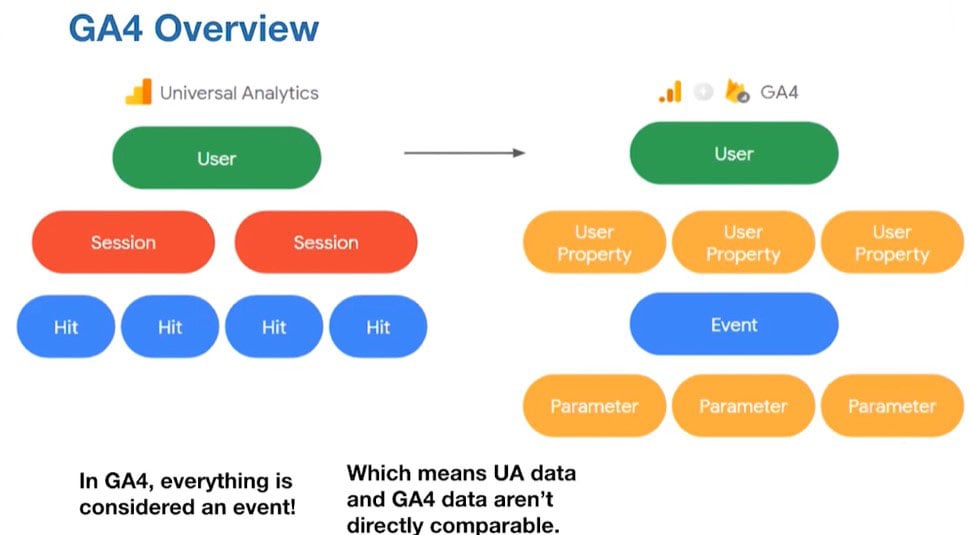

Comparing the methodology of how data is processed in the old UA and GA4

Under UA, website activity is session-based and under a session, there may be multiple hits (essentially an event such as pageview hits, clicks, or conversions). With GA4 everything, including the session itself, is considered a hit. When someone comes to your website for the first time or as a returning user, GA4 will track events as they started a session which allows for deeper granularity on how you can segment your data. Any event that fires can have different parameters to break data down further.

One of the biggest differences in methodology is that there is not a direct comparison between UA and GA4 with some of the data. There are similarities in the number of users and sessions but not quite event for event. The data will not match up perfectly due to the methodology of how the data is tracked.

What is different about GA4?

- It's built for the future of mobile applications and cross-device tracking (website and mobile app). It collects website and mobile app data in the same account but UA didn’t do that.

- The methodology to track data means everything is event-based versus session based.

- There are predictive analytics capabilities. If a lot of people are converting on your website and you want to find others who are taking similar actions but have not yet converted, GA4 can provide that information.

- There are more privacy controls such as cookieless measurement and behavioral and conversion modeling.

- There is no longer a direct-to-conversion path since it is very rare that a first-time visitor to a website goes directly to complete an action. Usually, a visitor comes from multiple channels before making a purchase or becoming a lead so Google really emphasizes the user journey in GA4.

- Dashboards can be customized.

Steps to Setup GA4

Do the Prep Work

- Watch the full webinar

- Read and watch more about the UA → GA4 migration

Basic Setup

- Set up a GA4 account from your Universal Analytics account

- Set up a data stream in GA4

- Add a configuration tag to the website (Google Tag Manager)

Verify Tracking

- After 2 weeks compare UA and GA4 sessions and users to make sure there isn’t a large discrepancy

Custom Setup and Decisions

- Set up cross-domains for all websites you want to track

- Set up event tracking on Loan Origination Software. (may require additional Google Tag Manager configuration.)

- Configure conversions to track the most important events

- Set up dashboards/reporting to focus on key metrics

Dig in and Start Exploring!

Questions about GA4? Drop them in the comments and we'll try to address them in an upcoming post or webinar.

Watch the full webinar: GA4 Anxiety? Get on Track for the July 1 Conversion.

Or visit our Credit Union Data Analytics and Tracking page for more information on how we help credit unions with full-funnel tracking and reporting.

Agree, disagree, or just have something to add?

Leave a comment below.