You know the difference between your credit union and local and national banks. Banks can’t compete with your interest rates. You also know that you provide more personal, attentive customer service than banks.

But what about your potential members...do they know the difference?

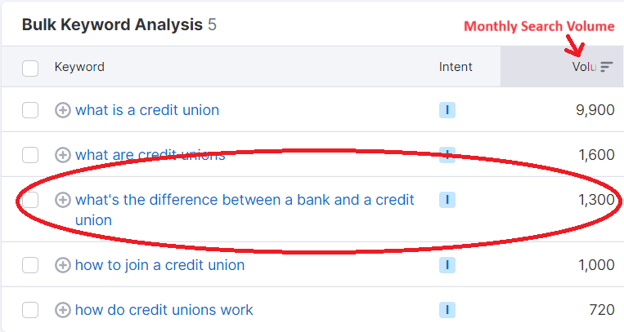

The answer is no, they don't. Look at the screenshot below – these are some of the most common questions asked in Google related to credit unions.

These insights show that 1,300 people every month are trying to figure out what’s the difference between a bank and a credit union. That's in addition to the 9,900+ people who have no idea what a credit union is at all.

Even once a person decides they would prefer a credit union over a bank, there's still the challenge of standing out from other credit unions.

So, how can you differentiate your credit union – not only from banks but also from your credit union competitors?

In this blog, we’ll discuss

- How to differentiate your credit union to stand out online

- Make your credit union more visible

- The cheapest way to earn more visibility

How to Differentiate Your Credit Union to Stand Out Online

When you’re competing in a saturated market like banking, you must find a way to stand out. Unique branding, community service, and local events are all ways to stand out in the physical world. You probably have a good grasp on that already.

But marketing credit unions in the digital world is a whole different ball game...

Here are some ways to differentiate your credit union online. This will help you generate new customers and encourage existing members to use more of your products.

Make your credit union more visible

Think about this: when your customers drive around, they probably have a hard time remembering your credit union over others. And you can't blame them. Most credit unions share similar naming schemes.

In Richmond, for example, here's what you'll find:

- Credit Union of Richmond

- Richmond Federal Credit Union

- Richmond Heritage Federal Credit Union

- Virginia Credit Union

Other credit unions often have long names that include "federal credit union" or "financial federal credit union." These long titles make them hard to remember, and the similarities make it hard to tell them apart.

A similar issue occurs online...

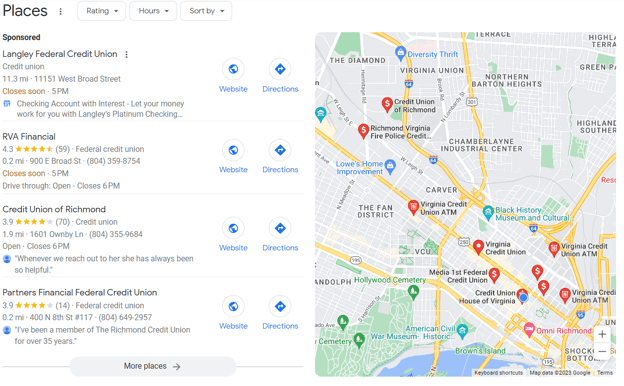

Look at these search results for "credit union richmond va":

None of these credit union names stand out. And if you're location isn't in your credit union's name, you're probably not even showing up near the top of the search.

What does this mean?

It means that even worse than the people who pass your physical location and don't remember who you are, nobody is even seeing you online to start with.

That is unless you take steps to improve your visibility.

Luckily, there are several easy – and often inexpensive – ways to boost visibility online. Here are some of the most effective ways to get noticed online:

Boost Local Search Visibility

Local listings are key to boosting your local visibility. Even if you already have a Google Business Profile (GBP), you should explore other listings that potential members are using to find credit union offers and ensure your information is there. Some of the most popular listings (besides Google Business Profile) are:

- Apple Maps

- Bing

- Yelp

- Foursquare

Optimizing your credit union's presence on local listings is no longer a choice but a necessity. These listings are where potential members turn when seeking financial products in their vicinity, and it's essential that your credit union shines brightly among the options.

When it comes to GBPs, conforming to Google's guidelines is paramount. Non-compliance can lead to your credit union being buried in the search results, making it unlikely for potential members to discover your offerings.

Ensure that you regularly audit your local listings. Verify that addresses, phone numbers, and hours of operation are not only present but also accurate and up-to-date. This attention to detail ensures that you're making the most of your local listings and positioning your credit union for success in the digital realm.

Gain visibility with search and display advertisements

You probably already know about Google AdWords and there's a reason for that: it works!

The goal of search ads is to show up when your customers are searching for services you provide. Display ads put you in front of your potential customers while they're in the "consideration stage," and they'll show up on other sites that users visit.

The targeting tools with AdWords are advanced and allow for incredible accuracy and optimization. If you haven't already launched an AdWords campaign, you're missing out on a major opportunity to increase visibility and, arguably, one of the best ways to generate qualified leads.

One of the most effective and cheapest ways to leverage Google ads is through remarketing. Remarketing allows you to show ads to people who have already visited your website.

Remarketing is a great credit union advertising tactic because it makes it easy to customize messaging according to the pages people have visited and it's typically less expensive than traditional search and display ads.

When you're aiming strictly for more visibility, remarketing is a great place to start.

Boost exposure with social media advertising

Just like search and display ads, if you're not already leveraging social advertising then, frankly, you're not keeping up.

To be clear, this is different from your organic social media activity. Social media advertising means leveraging the advertising tools provided by social sites like Facebook, LinkedIn, Instagram, TikTok, and so on.

You may be surprised to learn that the advertising tools from these sites offer great targeting, analytics and customization features.

Social media advertising is important for a simple reason: that's where your customers are; that means it's where you should be as well.

One of the keys to being successful with these ads is understanding which social platforms your target audience is using.

For instance, if you're targeting college students, then you may not have much luck with LinkedIn or Facebook – you'll probably see more success from Instagram and TikTok.

Just like Google, many of these platforms allow you to run remarketing ads, and they can be just as rewarding through social media.

The cheapest way to earn more visibility

Advertising tactics help you get in front of potential credit union members quickly. But even the cheapest ad campaigns aren't as inexpensive as using your own website.

I know what you're thinking: "We already run banner ads on our homepage with our latest rates and coolest new features."

Okay – that's great. It's prominent real estate and most credit unions I've seen do display "ads" for products and services.

If you're not already doing this, you should be. Think about how those banner graphics can be improved (and there's ALWAYS room for improvement) – make that space work for you and you'll start to see some extra revenue from cross-promotion.

Some ways to get more visibility from your website:

Build a strong organic presence

We all know that SEO (search engine optimization) is important, but what does it actually mean to optimize your website for SEO?

Using tools like Semrush or Moz, you can identify what terms potential members are using when searching for products like credit cards or savings accounts. Then, you can include those terms in your website to make it more likely to appear when people search for those products.

That said, it’s not that simple. You could add those keywords to your website and never appear at the top of a Google search. There’s so much that goes into organic search optimization that the is best to leave it to professionals on the matter.

However, your credit union's success depends on more than just SEO tools. It hinges on positioning your organization as a valuable resource for financial advice. That's where the importance of organic presence truly shines.

When your credit union establishes a robust organic presence, you're not just chasing rankings on search engines; you're building trust and authority.

Heatmapping tools

Heatmapping tools help you to see how visitors are using your page, including what they're clicking on (and not clicking on). Hotjar offers a free tool that's good enough for most companies.

A/B testing

This simply means testing one version of something versus a second version of something. A simple example would be to test two different banner images on your homepage – whichever one gets clicked on the most is the winner. It's that easy! The best part is that you can A/B test (almost) anything. A few more test ideas:

- Position of elements, such as buttons, login, important information

- Page and element colors and graphics

- Complete page design - test completely different pages to see how an overhauled page would impact your business

Use popups

Popups are a great way to introduce visitors to products, services, and other features that are special about your credit union. You can launch popups across your whole site or specific pages. You can also choose many other campaign settings.

Be more visible to differentiate your credit union

You know that you have unique products and services for the people in your community. But they don't because you don't have the visibility it takes to overcome the big banks and large credit union brands.

The good news is that gaining visibility using credit union digital marketing isn't complicated and it's not even expensive. Google and social advertising offer proven ROI when done the right way and are must-use strategies for credit unions who want to maintain market share.

Once you gain that visibility, you have a perfect opportunity to educate potential customers about the benefits of a credit union versus a bank.

There are also great approaches for adding visibility for current customers and website visitors by taking full advantage your website. These can often be executed internally or inexpensively using outside resources.

Learn more about credit union marketing strategies to help your organization attract more members online.

Do you feel like your credit union isn't differentiating itself from other financial institutions? Comment here to ask questions or give us a call at 804-200-4545 to learn more about how to differentiate your credit union using the approaches mentioned above.

Get Help to Differentiate Your Credit Union

Note: This post was originally published on October 9, 2017, with updates on November 15, 2023.

Agree, disagree, or just have something to add?

Leave a comment below.