Credit unions have long been talking about fintechs and their implications for the financial industry. WebStrategies has been deeply curious about this as well so we hired an outside research firm to dive deep into the public's perception of credit unions and online-only banks, among other things.

The main question we wanted answered was this: Is there a difference between how credit union members perceive fintechs vs. how non-credit union members perceive fintechs? And how does age come into play with these perceptions?

While we haven't yet released the entire study, there are few key highlights that we shared in our most recent credit union marketing webinar (you can be among the first to access the full study by subscribing to email updates).

Why are Fintechs So Popular?

We know that fintechs are gaining popularity, particularly among millennials and younger. But what do fintechs do that is earning the business of these highly desirable age groups?

Fintechs eliminate friction in the process of managing money. If any part of the financial user experience is unpleasant (whether that is applying for a loan, paying bills, investing, managing finances, moving money), fintechs have solved (or is trying to solve) that problem.

That strategy is working for them. According to our research, nearly 2/3 (61%) of consumers under the age of 45 are customers of an online-only bank. The competition is fierce.

What Do Credit Unions Identify as Their Value?

We know that fintechs are widely used so the question becomes, "how do credit unions measure up?"

WebStrategies Director of Business Development Kristin Harrison speaks to credit union marketers every day. She said the number one thing credit unions tout as their value is the member relationship (which we would classify into the bucket of customer service for the purpose of our research), followed by community involvement, competitive interest rates, and reasonable fees.

Unfortunately, what the credit unions identify as their value and what consumers are looking for are not always in alignment.

Credit union members who were under age 45 and using the credit union as their primary financial institution said that they most valued the following:

- Customer service

- Mobile app experience

- Accessibility

- Reasonable/no fees

Interestingly, financial education, which many credit unions put a great deal of emphasis on, is of least importance to this group. We believe this is due to the fact that financial wellness information is so widely available for free on other platforms.

Keep this in mind: the cardinal sin that a marketer can make is to promote something your target audience doesn't care about. Even if your credit union offers the best financial education available, marketing efforts in this area will likely fall flat.

How Credit Union Members and Non-Credit Union Members Perceive Credit Unions, Banks, and Fintechs

To get the right message in front of prospects, it is of utmost importance for credit union marketers to understand how they are perceived by the public. Here is what we learned:

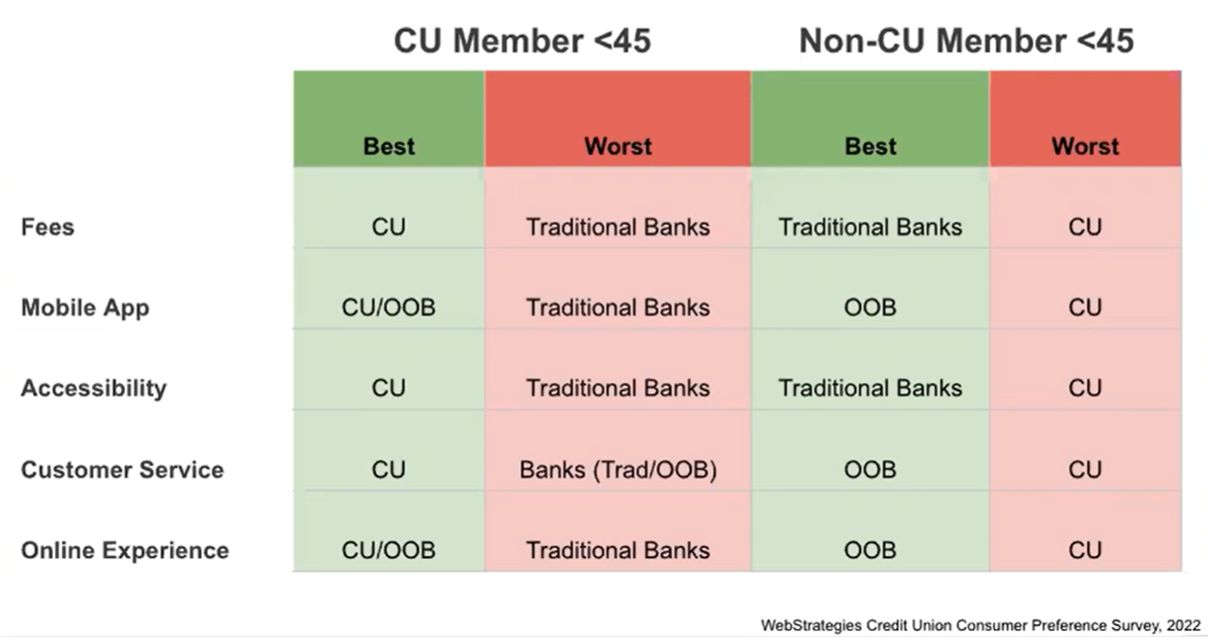

Credit union members under the age of 45 think that credit unions are the best at key value drivers of fees, mobile app, accessibility, customer service, and online experience. Non-credit union members in this age range believe credit unions are the worst at these key value drivers.

The chart below visually demonstrates this dramatic difference.

We shared even more data in our latest webinar. You can access the webinar and much more helpful information for credit union marketers in our webinar library.

Agree, disagree, or just have something to add?

Leave a comment below.