Even as a digital marketing agency, we know there are benefits credit unions realize through direct mail campaigns to reach members and potential members. The keys to doing that well are using an integrated CRM that can provide information and working with a vendor such as Conquest Graphics to convert that data into advertising, tailored to a member, or potential member’s, current needs. Now that the volume of direct mail has tapered off in most households, it is easier to get attention than in previous years.

In speaking with Chris Anderson, VP of Marketing at Listerhill Credit Union, to reach 100% of members a combination of the two tactics is necessary and any piece of information that is used to trigger an email can also be used to trigger a direct mail piece. At Listerhill, marketers found that members valued the tangible messages and found them more credible than email.

Postcards vs. Letters

Postcards are great options for marketing messages because they are easy to read (no opening), attention-grabbing, and lower cost. However, when providing account service information within a promotion, a letter in an envelope is necessary since privacy is required when sending any type of customer account information.

The following seven ideas for automated direct mail are suggestions to reach members and potential members but the opportunities to leverage your data are limitless. Use what you know about your members to delight them with reminders that you value them and reach them at pivotal points in life with offers for products they need.

Manual imports between the core system and CRM such as HubSpot or CRM Dynamics may be necessary to achieve some data integration functions, but often the CRM and core system integrate for a smooth process.

Credit Union Direct Mail Member Communications

1. Onboarding with a Combination of Email and Direct Mail

When a new member opens a savings account or a line of credit, there are maintenance and disclosures to send. Use a combination of direct mail and email to provide details on how to make payments or deposits, the features they can enjoy on the mobile app and website, and addresses of other convenient branch locations.

2. Transactional, Trigger-Based Mail

Use credit card or checking account transactions to identify members who are making large purchases on home or auto repairs. For example, people who spent a lot of money at a home improvement store may benefit from a HELOC or personal loan while those with large payments at auto repair locations may be in the market to replace their vehicle and seek an auto loan.

3. Auto Loans Approaching Payoff

As a credit union marketer, you know the average life span of members’ auto loans (or you can find out). When a member’s loan is approaching the end of that timeframe, use trigger-based retention ads to recapture new auto loans. Some credit unions see a large percentage of their client base that gets a new car every two years. Leverage what you know about your members’ buying habits in order to get messages in their mailbox when they are most likely shopping for their next vehicle.

4. CDs with High Balances

For CD holders with high balances, send communication with statistics about the improvement they could have seen if money was moved to investment services.

5. Delight Your Members

Give the member services team the ability to easily trigger a mail piece to follow up on an interaction. Set up an easy-to-send postcard that the team member can trigger easily to follow up on a service they provided so members feel recognized and valued.

Credit Union Direct Mail Lead Generation

Lists purchased from Equifax or other sources can be used for direct mail advertisements to reach people who are not currently members but may share traits of your member base. Lists of mailing addresses can be scrubbed of current members and then targeted to areas such as:

6. Radius Mailing

Market to your members’ neighbors and those who live near your branches.

7. Look-Alike Analysis

Market to potential clients who share the same key characteristics as your most successful members.

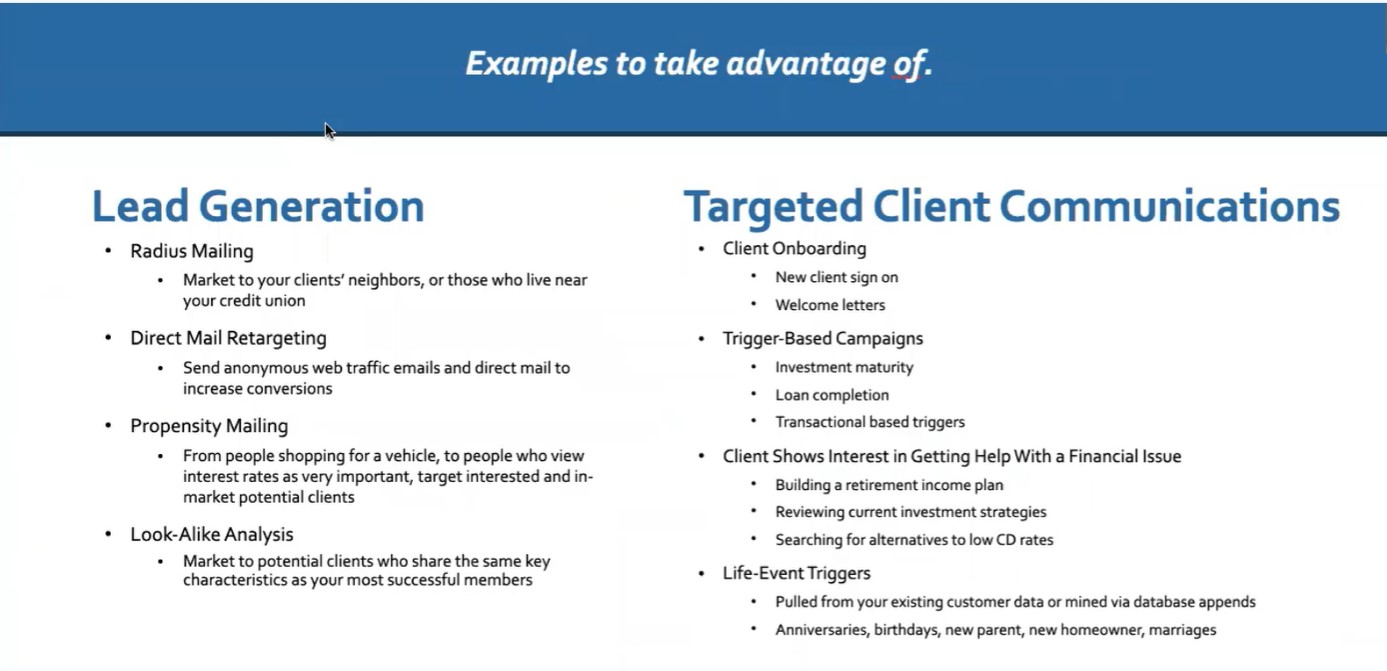

Additional ideas for direct mail marketing for lead generation and targeted client communications:

Watch the full recording of the webinar with Chris Anderson, VP of Marketing at Listerhill Credit Union, and Brian Redden, VP of Sales and Marketing Conquest Graphics, a technology first commercial printer, for details on implementing direct mail marketing at credit unions.

You may also be interested in:

- Our revised 2022 Credit Union Marketing Budget Calculator

-

The full page of Credit Union Marketing Resources

Agree, disagree, or just have something to add?

Leave a comment below.