.jpg?width=1600&name=google-analytics%20(1).jpg)

What do our credit union clients want most? Tracking! Many of our credit union clients come to us because they want better tracking and reporting. They want to be able to show that their digital marketing efforts are making an impact on business, leading to submitted applications.

The tricky thing about tracking with Google Analytics is that it requires installing Google Tag Manager (GTM) code on loan/account applications to collect the most data. And not all LOS providers are willing to install the GTM code.

That said, if you are reading this and your credit union uses NetIt, you fall into the category of LOS limitations. NetIt does not allow Google Analytics on applications through the use of GTM which means you will not be able to see submitted applications, break those submissions down by marketing campaign, or have full visualization of the loan funnel.

You may be able to track button clicks through the use of Google Analytics, which provides an estimated calculation of application starts.

Why Credit Union Marketers Want Better Tracking

Though that is disappointing to hear, it is important to understand the capabilities of tracking in the event that NetIt changes its policies regarding GTM or your credit union switches LOS platforms. This article explains which LOS platforms are the best from a tracking perspective.

Having full tracking provides invaluable insight for digital marketers. With full tracking in place, users see submitted applications and break them down even further to determine their source and campaign. For example, you can see how many auto loan applications came from a specific Google Search advertising campaign in a given time period.

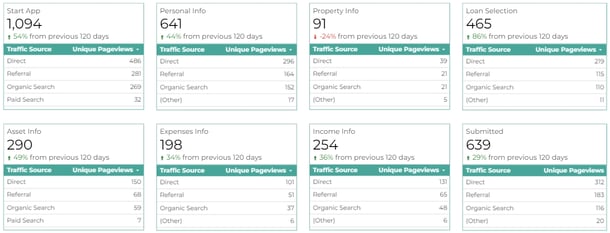

Tracking installed through GTM also allows you to visualize the loan funnel and see where users are dropping off in the application. Here is what that looks like when it is built out in Datastudio, one of our favorite reporting tools:

To take this one step further, some credit unions are able to track funded loans to determine the ROI of digital marketing efforts.

This is done by implementing GTM on the credit union's website and sending unique, anonymous data into the LOS; marketers can then export the data and combine it with campaign data and loan information. This provides the clarity to determine which campaigns are the most effective based on ROI.

Data can be displayed like this using Datastudio:

![]()

![]()

More details about this additional level of tracking can be found in this article.

Tracking with Google Analytics does take an expert to install and ensure all data populates correctly. WebStrategies has successfully installed Google Analytics on a number of LOS providers for credit union clients that now enjoy the benefits of better, clearer tracking.

Want to know how far your tracking can go? Contact us to discuss your credit union's specific situation.

Contact Us

Note: LOS providers can change their rules and regulations regarding installing GTM code on applications. At the time of publishing, NetIt does not allow the installation of GTM code for tracking.

Agree, disagree, or just have something to add?

Leave a comment below.